How to use Zen Ratings to beat the market

Updated

by Nate Tsang

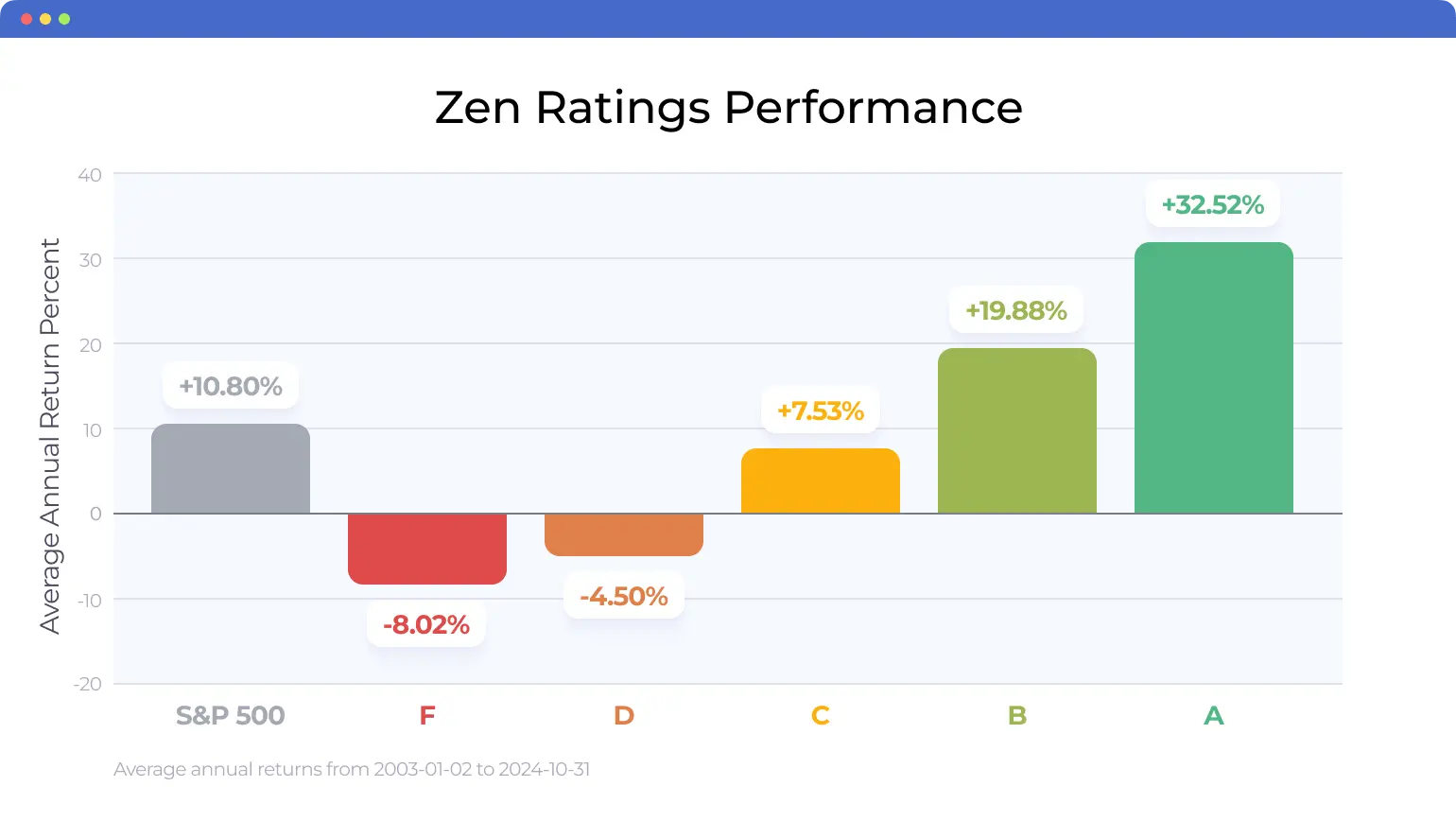

The only reason to use a ratings system to select stocks is that you firmly believe it leads to superior performance.

Gladly the Zen Ratings offers ample proof of that given over 20 years of outstanding results:

That's right. Our A rated (Strong Buy) stocks have produced an average annual return of +32.52% since 2003.

This return implies that the Zen Ratings helps you outperform the market by more than 3 to 1.

The root cause of this outperformance comes from our proprietary model analyzing 115 different factors for every stock. Everything from growth to value to momentum to exclusive AI factors.

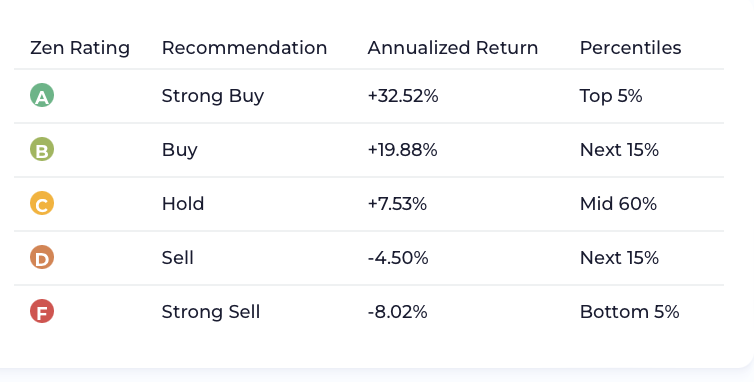

Every market day we analyze over 4,600 stocks using this system to determine those with the most upside potential. This results in a percentile rating for each stock which translates to a letter grade and recommendation as shared below:

Plain and simple, you want as many stocks with A and B overall Zen Ratings in your portfolio given their high likelihood of superior performance.

Just as important is isolating sell rated D & F stocks to remove them from your portfolio ASAP before they do any serious damage.

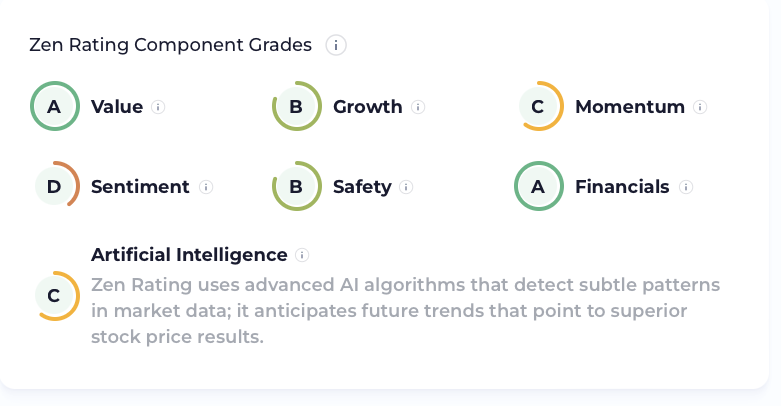

Because we understand that different investors value different things when it comes to stocks, we also devised 7 additional Component Grades for every stock to quickly help you narrow down to the stocks that are the perfect fits for you.

Here is an example of how these additional ratings appear on our quote pages:

The key thing to remember is that these component grades are ONLY to be used after first reviewing the overall Zen Rating for the stock.