How do you use analyst stock ratings to buy/hold/sell stocks? How should you use analyst ratings?

Updated

by Lincoln Olson

Updated

by Lincoln Olson

There's a fundamental problem with analyst ratings: Which stocks ratings should we pay attention to?

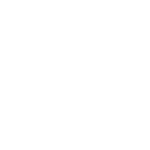

If Richard Davis marks a stock you own as a "Strong Sell", should you sell it? Should you hold it? Should you buy more?

And who the heck is Richard Davis!?

For a complete answer to these questions, check out this blog post: How to Use Analyst Stock Ratings to Buy/Hold/Sell.

The problem with analyst stock ratings

Let's say you own stock ABC.

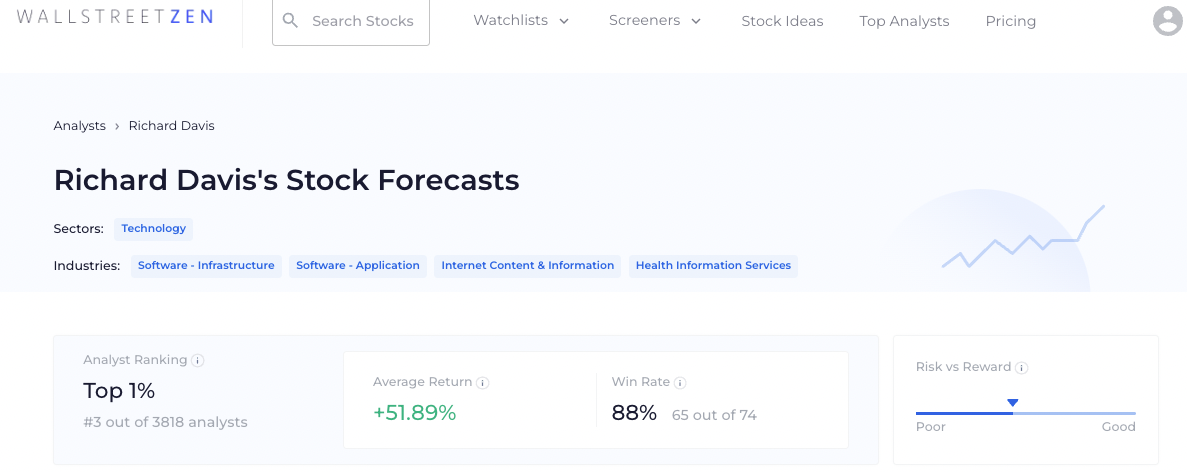

Kyle Mikson, an analyst who covers ABC, just marked it as a Strong Buy. Richard Davis, on the other hand, marked it as a Strong Sell.

Both analysts can't be right.

Who do you listen to? Which analyst is right? Should you buy, hold, or sell ABC?

The problem with analyst stock ratings is we don't know which analysts to pay attention to and which ones we should ignore.

Until now.

Why we built Top Analysts

WallStreetZen tracks historical analyst recommendations so we can identify the top-performing analysts on Wall Street.

By identifying the top 1% of analysts (based on average return, win rate, and frequency), you can get stock ideas and forecasts by proven performers.

What that means for you: You no longer need to blindly follow or ignore analyst buy/sell/hold recommendations. Look up the analyst and see if their forecasts are worth their salt.

Sorry Kyle, but I'm probably going to do the opposite of whatever you recommend.

Start using Top Analysts today.

For unlimited access to the top 1% of analysts on Wall Street and our other premium features, hit the button below: